Preparing for your meeting

Learn tips for meeting with your financial advisor in 10 minutes! This section offers videos and quiz questions to make sure you've memorized the most important points. Got a meeting coming up?

The investment consultation

There are strict guidelines for an investment consultation: advisors are required to ask you many questions, especially about your finances. However, if it's important for you to invest in line with your values, make sure to say so! Your advisor needs to take this information into account.

Learn more about the topic in the video!

Data protection notice

Why is it so hard to have an impact?

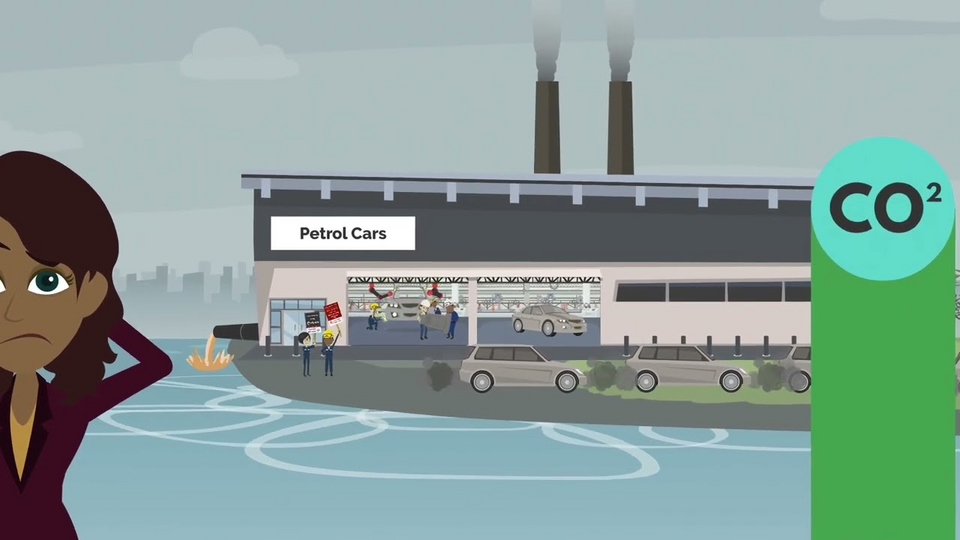

As an investor, it's not always easy to have a positive impact on the environment or society with your money. Investing money works differently than shopping in the supermarket. For example, only a few investment products can actually prove that they directly reduce CO2 emissions. Any promises about this should be carefully scrutinized!

Learn more about the topic in the video!

Data protection notice

Rules of the game

There are clear rules for investment advice sessions that providers must follow. The most important point is that recommended products must fit you and your financial and sustainability preferences!

Learn more about the topic in the video!

Data protection notice

Speak your mind!

In August 2022, the EU Commission made it mandatory that financial advisors also ask about the sustainability preferences of their clients, on topics like the environment, social issues or corporate governance. However, there is an alarmingly low level of regulatory compliance in Europe. This means that retail clients need to be aware of their rights and ask questions in case of doubt.

Learn more about the topic in the infobox!

What could go wrong?

In order to evaluate the current state of retail advisory, 2° Investing Initiative carried out roughly 350 undercover client meetings across Europe . Over and over, the consultations were incomplete, too general or failed to consider clients' wider sustainability motivations such as having an impact with their savings. Often, advisors failed to adequately complete client profiles or address their sustainability preferences, and sometimes they even recommended inappropriate products.

Data protection notice

If you want to know more

Determine your personal sustainability profile!

Gain transparency in our fund database!