Climate Performance

The information in this section is based on individual indicators of the Swiss Climate Scores recommended by the Swiss Federal Council.

Paris Score Similar to a school grade, the letter describes how well a fund is in line with the Paris Climate Agreement to limit global warming to 1.5 °C. The legend shows which letter is related to which climate scenario. The legend shows which letter is associated with which climate scenario. The planned expansion of climate-friendly technologies (e.g. renewable energies or electric cars) and dismantling of climate-damaging technologies (e.g. coal and oil-fired power plants) by companies in the most energy-intensive sectors is compared with the targets of international climate scenarios for 2026. Companies from seven sectors are included in the calculation for the fund, which together are responsible for about 75% of global CO2 emissions. These include companies from the following sectors: power generation, coal, oil, gas, steel, cement and the automotive industry. (Data source: RMI, based on Asset Impact data ) More information in the glossary. The graph on the right shows the historical development of the fund's Paris Score. If the fund has not invested sufficiently in the most climate-relevant sectors, no score is given. The corresponding field at a point in time remains empty.

Positioning of the Paris score of the fund compared to the fund universe

-

A+

-

A

- ≤ 1.5°C

-

B

-

This Fund

is in the efficiency class C

C -

D

-

E

-

F

Climate stewardship of the management Financial institutions can contribute to the transition to net zero by advocating for climate-friendly business operations and credible transition plans with invested companies. Direct dialogue with a company and exercising voting rights has been shown to be one of the most effective strategies for positive climate impact by investors. The British NGO FinanceMap has rated large asset managers in terms of their climate influence (so-called climate stewardship). Similar to a school grade, the letter describes how credibly an asset manager influences companies to bring them into line with the Paris Climate Agreement. This includes, for example, influencing the business model, escalation strategies and voting on climate-related resolutions at shareholder meetings. "A" stands for strong and consistent commitment to corporate transition in line with the Paris Agreement, F for "insufficient". Both company data and external data were used for this. (Data source: FinanceMap)

If a fund has no rating, the asset manager has not yet been rated due to its relatively small size. FinanceMap's rating is currently limited to the 30 largest majority investor-owned asset managers worldwide. (Data source: FinanceMap)

Science-based climate targets

Companies Taking Action Tooltip

More and more companies are voluntarily committing to net-zero emissions targets and formulating interim climate targets. Net-zero targets indicate how many emissions a company must reduce and offset by 2050 at the latest in order to meet the company's contribution to achieving the Paris climate goals - limiting global warming to 1.5°C. The effectiveness of such commitments depends on whether the interim targets are credible, science-based and transparent. The methodology for science-based climate targets used here was developed by the Science Based Targets Initiative (SBTi). (Data source: Science Based Target Initiative)

Proportion of companies in the fund with public commitments to net-zero emissions targets and verified science-based interim climate targets.

Fossil fuels The weighting of companies in the fund which main sector is fossil fuel extraction plus the weighting of the fossil fuel capacity of companies in the power sector. As an example, a portfolio with a share of 10% of oil extraction companies and a share of 10% in power companies with each 20% coal capacity would show: 10%+10%*20%= 12%. A threshold of 5% of revenues applies both to activities directly linked with the exploration and production of fossil fuels and, if data is readily available, activities financing such production. The scope of activities includes the whole value chain, ranging from exploration, extraction, and production (upstream) to transportation and storage (midstream) and refining, marketing, and electrification (downstream). (Data source: RMI, based on Asset Impact data)

The weighting of companies in the fund that are active in the mining and/or conversion of coal into electricity is shown. (Data source: RMI, based on Asset Impact data)

The weighting of companies in the fund that are active in the production and/or conversion of oil and/or gas is shown. (Data source: RMI, based on Asset Impact data)

Renewable energies The weighting of the renewable energy capacity of companies in the power sector. As an example, a portfolio with a share of 10% in power companies with each 50% renewable energy capacities would show: 10%*50%= 5%. (Data source: RMI, based on Asset Impact data)

The weighting of the renewable energy capacity of companies in the power sector. (Data source: RMI, based on Asset Impact data)

Controversial corporate shares in the fund The figures refer to the share of companies in the fund that are involved in controversial activities. They cannot be summed up as it is possible that a company is involved in several controversial activities but is only counted once. Therefore, the total amount may be lower than the sum of the shares listed below.

Environment

Environment

-

Genetically Modified Organism0.00%The weighting of companies in the fund that are involved in the production and/or processing of products from genetically modified organisms is shown. This includes companies that are involved in the production of seeds, crops and/or food additives with the aid of genetic engineering. It also includes companies involved in the production of pharmaceutical drugs or active ingredients, industrial chemicals, biofuels and/or other consumer products using genetic engineering. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Palm Oil1.06%The weighting of companies in the fund that are involved in the production, distribution or processing of palm oil and finished palm oil-based products is shown. This includes companies involved in the cultivation of oil palms (producers), the operation of palm oil mills, refineries and/or fractionation plants (processors), the manufacture of finished products using palm oil, including food and non-food products (chemicals, biofuels, personal care products) (users) or the distribution of crude palm oil, palm kernel oil, palm kernel flour, derivatives or fractions (distributors). If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Controversial pesticides>0.01%The weighting of companies in the fund that are active in the production of pesticides containing ingredients classified as extremely or highly hazardous by the World Health Organisation (WHO) is shown. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Nuclear Energy>0.01%The weighting of companies in the fund that are active in the extraction and/or conversion of uranium into electricity is shown. (Data source: RMI, based on Asset Impact data)

-

Controversies in the field of environmental protection3.15%The weighting of companies in the fund that are involved in serious or very serious environmental controversies according to ISS ESG is shown. These include violations of international environmental standards, such as the Rio Declaration on Environment and Development, the Biodiversity Convention or the Paris Climate Agreement, among others. The assessments are updated when relevant new information is available or at least annually. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Non-signatories of the Paris climate agreement0.00%The weighting of government bonds in the fund issued by countries that have not ratified the Paris Climate Agreement is given (data source: UN).

-

Non-signatories to the Convention on Biological Diversity0.00%The weighting of government bonds in the fund issued by countries that have not signed the Convention on Biological Diversity is indicated. This Convention aims to protect the Earth's biodiversity, but also genetic diversity and the diversity of ecosystems. (Data source: UN)

Social topics & ethics

Social topics & ethics

-

Controversial Weapons>0.01%The weighting of companies in the fund that are involved in controversial weapons (ABC weapons, anti-personnel mines, incendiary weapons, cluster munitions, uranium munitions and armour, white phosphorus munitions) and/or generally involved in the production, distribution or provision of services related to controversial weapons is presented. If you have any queries regarding the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Civil Weapons or Military Equipment0.00%The weighting of companies in the fund that are involved in the production, distribution or provision of services related to military equipment (weapons of war, supporting military equipment, as well as their components) or/and civilian firearms is presented. Services include maintenance, repair, testing, transport and similar activities in the above areas. This indicator is broadly defined, so that it also includes companies that are active, for example, in the field of logic (e.g. by transporting tanks) or that produce goods that have both civilian and military uses (e.g. oxygen masks for pilots), provided that these goods have been specifically developed or modified for military use. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Controversies in the field of human rights15.39%The weighting of companies in the fund that are involved in serious or very serious human rights controversies according to ISS ESG is presented. These include violations of international human rights standards, such as the International Bill of Human Rights, the International Covenant on Civil and Political Rights (ICCPR) or the International Covenant on Economic, Social and Cultural Rights (ICESCR), among others. Assessments are updated when relevant new information is available or at least annually. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Controversies in the area of workers' rights25.84%The weighting of companies in the fund that are involved in serious or very serious labour rights controversies according to ISS ESG is shown. This includes violations of international labour rights standards, such as the International Labour Organisation (ILO) Convention, among others. The ratings are updated when relevant new information is received or at least annually. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Violation of Animal Welfare4.84%The weighting of companies in the fund that violate animal welfare is shown. On the one hand, this includes companies that carry out animal experiments on live animals for non-pharmaceutical purposes. Secondly, this excludes companies that engage in intensive farming to produce food, including meat, eggs and dairy products, or companies that breed, trap or slaughter animals for their fur and leather. Companies that conduct animal testing for pharmaceutical purposes are not excluded. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Addictive Substances (Tobacco, Alcohol)0.00%The weighting of companies in the Fund that are engaged in the production of tobacco products and/or the production or distribution of alcoholic beverages is presented. The distribution of alcoholic beverages includes companies engaged in the wholesale or retail sale of alcoholic beverages, including liquor shops, supermarkets, bars and restaurants. It does not exclude services provided by enterprises engaged in the licensing, marketing and advertising of alcoholic beverages and/or tobacco, and also enterprises supplying key raw materials and packaging products specifically used in the production of alcoholic beverages and/or tobacco products, such as beer bottles, wine corks or cigarette packaging. This indicator does not require a minimum share of activities in turnover. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

States with Child Labour0.00%The weighting of government bonds in the fund issued by countries where child labour is widespread is shown (data source: ISS ESG).

-

Violation of Human Rights0.00%The weighting of government bonds in the fund issued by countries where human rights are severely restricted is indicated. (Data source: ISS ESG)

-

Violation of Labour Rights0.00%It indicates the weighting in the fund of government bonds issued by countries where labour rights are not sufficiently respected. This refers in particular to labour protection in terms of health and safety, minimum wages and working hours. (Data source: ISS ESG)

-

Authoritarian Regimes0.00%The weighting of government bonds in the fund issued by countries considered "unfree" according to the "Freedom in the World" index of the non-governmental organisation Freedom House is indicated (data source: Freedom House).

Corporate governance

Corporate governance

-

Violation of the principles of the UN Global Compact30.19%The weighting of companies in the fund that are involved in serious or very serious controversies in at least one of the four core areas of the UN Global Compact according to ISS ESG is shown. These include violations of international standards in the areas of environmental protection, human rights, labour rights and corruption. The ratings are updated when relevant new information is received or at least annually. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Corruption>0.01%The weighting of companies in the fund that are involved in serious or very serious controversies in the area of corruption according to ISS ESG is shown. This includes violations of international anti-corruption standards, such as the UN Convention against Corruption, among others. The ratings are updated when relevant new information is available or at least annually. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Business Malpractice12.91%The weighting of companies in the fund that are involved in accounting fraud, bribery, money laundering or/and anti-competitive behaviour according to ISS ESG is shown. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Tax avoidance strategies and identified infringements1.24%The weighting of companies in the fund that miss the intent and spirit of tax laws is presented. This includes companies that engage in illegal tax evasion by not paying or only partially paying taxes and/or that use tax optimisation strategies or aggressive tax planning, such as targeted profit reduction and profit shifting, even if these do not fall within the scope of illegality. If you have any queries regarding the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

No women on the Executive Board or Supervisory Board>0.01%The weighting of companies in the fund that do not have women on their management and/or supervisory boards is shown. If you have any questions about the company data, please contact ISS ESG directly. (Data source: ISS ESG)

-

Countries with nuclear weapons0.00%The weighting of government bonds in the fund issued by countries listed by SIPRI as possessing nuclear weapons is given. (Data source: SIPRI)

-

Global Peace Controversy0.00%The weighting of government bonds in the fund issued by countries classified as "very low" in the "Global Peace Index" of the non-governmental organisation "Institute for Economics and Peace" and thus considered to be very conflict-prone is indicated. (Data source: Institute for Economics and Peace)

-

Perceived corruption0.00%The weighting of government bonds issued by countries rated "very corrupt" by the "Corruption Perception Index" (CPI) of the non-governmental organisation "Transparency International" is issued. The CPI rates 180 countries and regions according to how corrupt the public sector is perceived to be. (Data source: Transparency International)

-

Money Laundering Controversy0.00%xmtdiifunddatabase.detail.flagSovereignExposureMoneyLaunderingControversy.description

ISS ESG Fund Rating

The rating of our partner ISS ESG ranges from 0 to 100, whereby 100 stands for "very good". The ISS ESG performance score represents an absolute ESG rating of the fund. For the calculation, the individual ratings of companies in the areas of environment, social affairs and corporate governance are combined and aggregated at fund level. The ISS ESG Performance Score therefore differs from the ISS ESG Fund Rating, as here stars are awarded relative to the Lipper Global Benchmark Class and thus a fund with a low ISS ESG Performance Score can also receive several stars in case of doubt. (Data source: ISS ESG)

Neither the ISS ESG performance score nor the fund rating can be used to infer the sustainability impact of the fund.

More on ESG ratings in the glossary.

- Not rated

Labels

- Not available

Transparency profile Funds that have reported under the Sustainable Finance Disclosure Regulation (SFDR), what percentage of their portfolio consider ESG factors (Art 8) or have sustainable objectives (Art 9) and which methodologies are used. More details can be found in the tool Tip on the right side.

Alignment vs. impact

Learn more about the difference between alignment and impact. The video explains why alignment is not the same as impact.

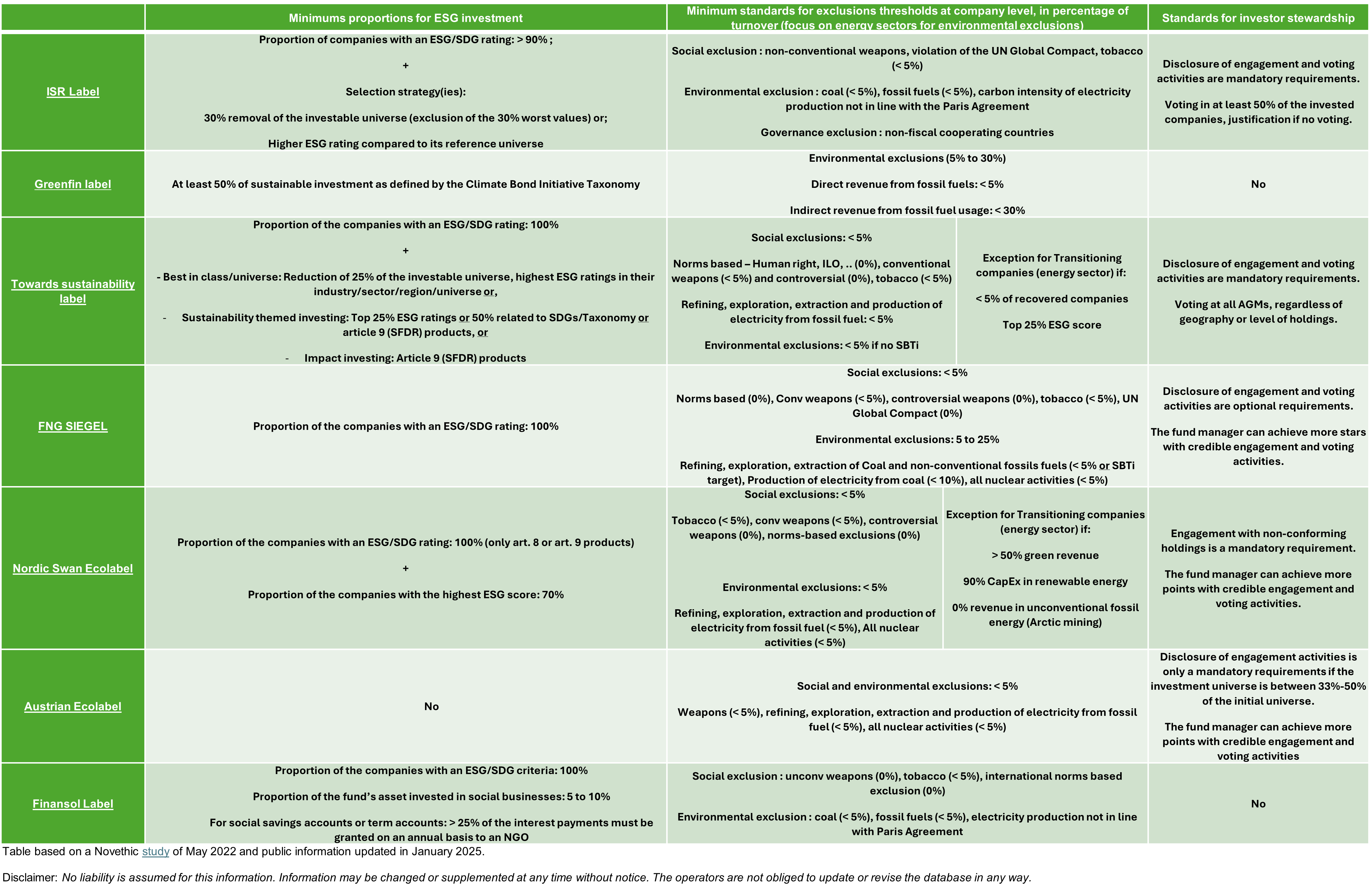

Watch videoLabels

Learn more about the difference between the labels and their criteria.

Fund data from: 31.05.2024

Source: Lipper